If you follow me on Instagram, you saw that as of this week, we officially paid off all of my student loans and other consumer debt. It was a big deal for us. I went to a private christian university that was very expensive. At eighteen years old I did not have the forethought to consider how the loans would affect me entering my adult life. There are a lot of things I would have done differently given the opportunity to do it all again. Coulda shoulda woulda. I figured in case anyone was interested, I would share a bit about our story in general, how we did it, some tips/tricks, and since you all are here for house content, how living on a budget affected my design style.

For some context, I got married six months after college at age 22. So from the moment I had to start paying on my loans, I was working with a (albeit fairly small) dual income. Unfortunately, I have no experience with being a young single professional trying to pay off debt, but I think a lot of the same principles can apply. We loosely followed Dave Ramsey’s Baby Steps. I say loosely because he advises not purchasing a home (if you don’t already own one) until your debt is paid off. We obviously did not do that. But we had almost 100k in a small credit card, one car loan, medical bills, and a majority student loans. It took us six years. That’s a long freaking time.

One thing we did was set a very intentional budget each month. We designated an amount for every expense we had. This form is a really helpful starting point. (By the way, none of this is sponsored, this is just what helped us!) The most important thing was deciding what was important and spending our dollars there. That might be different for everyone. If spending quality time out with friends is important to you, set aside an amount you’re willing to spend on that, and write it in the budget! Then, boom. You get to spend guilt-free money going out! Just don’t overspend in that category, and you have nothing to worry about.

One thing that helped us make sure we didn’t overspend in different categories was using a cash envelope system. In my wallet I have an envelope with cash for groceries, household items, entertainment, and personal spending money. This helped me make sure I wasn’t blowing my budget because I could clearly see how much money was left for the month. Personal spending money was vitally important because I never felt guilty about roaming Target as long as I had cash in my envelope. And you can bet your bottom dollar that if I had extra grocery money on my last grocery shopping trip for the month, I was going to spend $20 on a cookie cake. It’s not about depriving yourself, it’s about having a plan.

When we were writing our budget, everything extra on top of all of our normal expenditures went toward debt. There were months (before kids lol) that we would make an $2,000 payment toward our debt. Now, that’s not to say every month was perfect. There were long periods of time when things were really hard or we had to put a pause on things. We needed a new truck, so we saved up cash for a few months and didn’t pay anything extra on loans. We needed medical intervention to start a family. That cost us a lot of money. When we actually had our first child, those medical expenses were high (don’t get me started on the the high cost of healthcare in this country). We experienced a job loss and lived on one income for about a year and were just barely making it. There were normal highs and lows, but that’s part of the reason it took so long. We had to stay motivated through long periods of lows, and it was really freaking hard. I stay at home now, but for the first 18 months of my son’s life I was teaching full time and had a pretty high daycare bill. It ate quite a bit into our budget to be honest. But it all came down to the budget. We wrote in line items for formula, diapers, baby clothes, all of it. Kids are expensive, no way around it.

It was hard to stay motivated at times, I’ll be honest. Six years is such a long time. But we constantly reminded ourselves of how much easier life would be without these extra payments lying around. Once our kids were born, we knew it would be so much better for them growing up to grow up in a household where money isn’t a stressful topic. That’s what kept us going.

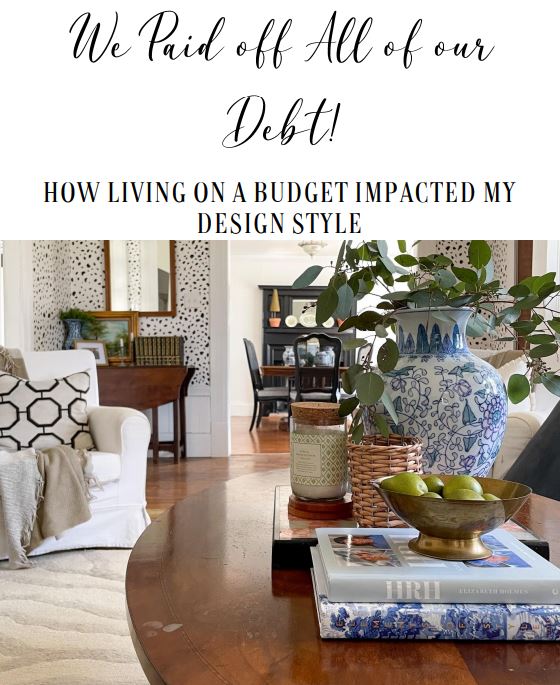

At the risk of making this the longest post I’ve ever written, I did promise to discuss how living this way has affected my design style, so I wanted to touch on that. Every month I would spend my “spending cash” on house stuff. But I wanted to stretch my spending money as far as it would go, hence the love of thrift stores, estate sales, and flea markets. Why would I pay $200 for a dining chair at Target when I could buy a whole set of higher quality dining chairs at a thrift store with a little patience and persistence for $40? (That is a real example, by the way.) And shopping secondhand made me appreciate classic, traditional pieces that were different from what was trending at the big box store. I had to practice a lot of patience and be content with what I had in the interim, but I’m grateful for the forced exercise in self control.

Does any of that make sense? I feel like I both rambled on and on and also barely scratched the surface. If you have questions, let me know. That’s all for today, friends! Have a fabulous day!